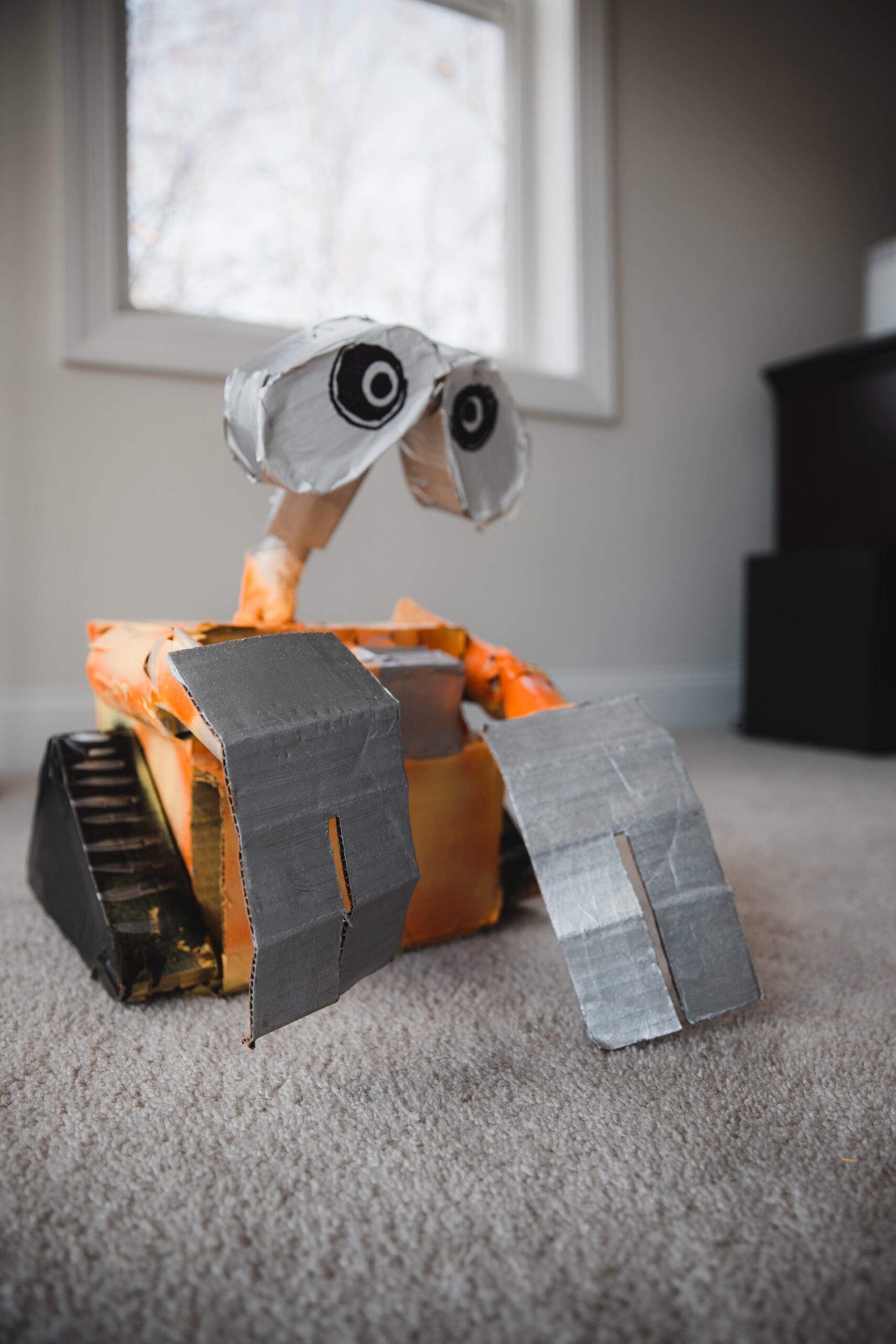

You can’t have failed to hear all the buzz about Artificial Intelligence (AI) this year, in particular language models such as ChatGPT. So we are asking will AI replace your human mortgage adviser?

Will AI replace your human mortgage adviser?

From helping jobseekers write a CV or covering letter, to putting together a household shopping list, it’s gradually becoming a much bigger part of people’s lives.

So it’s only natural then that many might consider using it for help with managing their finances.

But we’d urge caution if you’re thinking of using an AI tool instead of a living, breathing financial adviser, as a bot is no substitute for the real thing.

A human being knows you and your goals

Financial planners treat each and every client as an individual, and will offer advice on that basis. So any guidance or recommendations will be based on your specific needs, circumstances, goals, priorities and personal values.

A financial planner will also take a holistic look at your situation, so each step you take works to support your larger objectives.

Although AI does respond to prompts, it simply can’t have the same level of insight into your life and your aspirations as a real person.

With that in mind, it can’t show the same level of emotional support and empathy as a human being. Perhaps you’re feeling daunted by the task of getting your finances in order, confused by complex terminology or uncomfortable discussing issues such as estate planning and writing your will.

A flesh and blood financial planner will have the emotional intelligence and understanding to speak to you appropriately depending on the circumstances, how you’re feeling and what you’re talking about – and offer appropriate support and guidance.

AI offers general, rather than specific advice

Every single person has their own different financial circumstances, which is why financial planners offer bespoke advice tailored around each individual client.

While you can ask ChatGPT certain questions, it can only give you general advice based on other people’s experiences and existing datasets. And since it’s not taking a holistic look at your finances in the same way as a professional adviser, the advice it gives might not be the best option for you if you’re working towards a particular goal.

So while AI could, for example, be helpful in defining what certain terms mean, that doesn’t mean it can offer good advice. ChatGPT even acknowledges this, as it can answer with the disclaimer that as a language model AI, it can “provide information and insights on personal finance”, but can’t “provide personalised financial advice”.

Financial specialists offer reliable advice

Professional advisers are regulated and required to adhere to the highest professional standards. That means you can trust them to give accurate information and guidance, and always act in your best interests.

By contrast, you can’t be sure which sources AI tools are drawing upon to produce an answer, so there’s a risk that unreliable, unverified and untrue information is being generated.

Concerns have also been raised about AI algorithms having the potential for bias, which may influence the advice given to certain people.

Ultimately, the human element is impossible to replicate.

An AI tool can’t understand you, your current situation and your ambitions in quite the same way. It can’t build a meaningful relationship with you, and use that to inform the advice it gives.

And crucially, you can’t be sure that an AI tool is giving trustworthy and accurate information.

If you have any questions about making your money work hard for you and getting the most out of your investments, please don’t hesitate to get in touch with our friendly team of human specialists.

We’re here to help you achieve your goals and help you make the right decisions.

If this has got you thinking, we’d be delighted to help. Get in touch and we’ll talk you through your options, or sign up to our monthly newsletter, to keep your finger on the pulse.

Sam Murphy – 26th October 2023

Production

Production