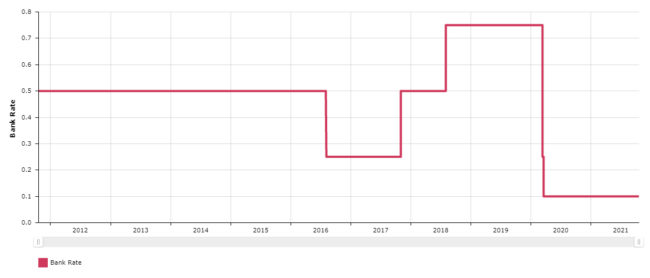

Today the Bank of England’s Monetary Policy Committee (MPC) voted to keep the Base Rate at the historic low of 0.1%, where it has been since March 2020 at the start of the pandemic.

The vote was 7-2 in favour of leaving the rate unchanged and the governor Andrew Bailey said it was a “close call”. Rather than react too quickly to rising inflation is seems the policymakers of the MPC have decided to wait and see how the jobs market copes with the end of the furlough scheme.

The MPC next meets in December and whilst a rate increase wouldn’t be a welcome Christmas present for borrowers, savers have been suffering with pitiful savings rates for years now, so it’s possible we might see in the new year with a higher Base Rate – only time will tell.

What’s been said?

In a BBC interview, Mr Bailey said current conditions were different because inflation was being caused by global “supply shocks” rather than demand pressure in the UK economy.

“Putting interest rates up, I’m afraid, isn’t going to get us more gas,” he added.

But he said that interest rates were not going to return to levels seen before the 2008 financial crisis.

“For the foreseeable future, we’re in a world of low interest rates,” he said.

“That doesn’t mean that they don’t rise and fall within that sort of bound. But I want to be quite clear, we’re not signalling that there’s going to be some very sharp return to the world that we can just about remember before the financial crisis.”

Mr Bailey said the MPC wanted to see “more evidence” of how the labour market was evolving before raising interest rates. However, he stressed: “We think there will be some need to increase interest rates to bring inflation sustainably back to target. And we will be ready to do that.”

The Bank still expects inflation to peak at around 5% in April 2022, which is more than double its target of 2%.

Why put up interest rates just because inflation is higher?

Historically, putting up interest rates drives inflation down, because it pushes up the cost of borrowing, meaning consumers spend less, demand for goods and services reduces and prices fall due to the lower demand. Inflation puts pressure on wages – effectively devaluing take-home pay because if prices are rising the same salary buys less this year than it did last year. That said, many of the upward pressures on inflation are caused by supply chain issues due to Covid, Brexit and international energy prices, so it’s complicated.

What does this mean for my mortgage?

- If you’re already in a fixed rate any changes in interest rates won’t affect you until the fixed rate ends. If it ends in the next 6 months then it’s worth getting advice because you might be able to reserve a new fixed rate now, to come into effect when your current deal ends.

- If you’re paying a relatively high fixed rate (more than 2.5%) and you’ve got more than 12 months left on your current deal, it might be worth taking advice from an independent mortgage adviser who’ll be able to help you work out your options and whether it’s worth breaking out.

- If you’re currently on a tracker, discounted or variable rate mortgage then it’s worth taking advice ASAP – you may well be free to move to a fixed rate without penalty.

Will the cost of new mortgages go up?

If (or rather when) the Bank of England increases the base rate, it’s impossible to say exactly what the effect will be on the mortgage rates available from lenders, but chances are they’ll increase to some extent. But it’s a complicated picture, because there are a number of factors affecting mortgage rates. Some mortgage lenders rely on the retail deposits they take in from savers to fund their mortgage lending – this typical building society model is quite stable,

whereas other lenders rely more on money they’ve bought on the money markets to lend to us – these lenders are more exposed to ‘swap rates’ which is what banks charge each other to borrow money.

Some lenders have already pulled some of their cheapest products. Whether this is a sign of things to come only time will tell, but at the time of writing there are still plenty of ‘best buy’ fixed rates at less than 1%, mainly for those with a deposit/equity of at least 25%.

If this has got you thinking, get in touch and we’ll be help you understand what’s possible, or sign up to our monthly newsletter, to keep your finger on the pulse.

Sam Murphy – 4th November 2021

Sources

Production

Production